-

Program Overview

-

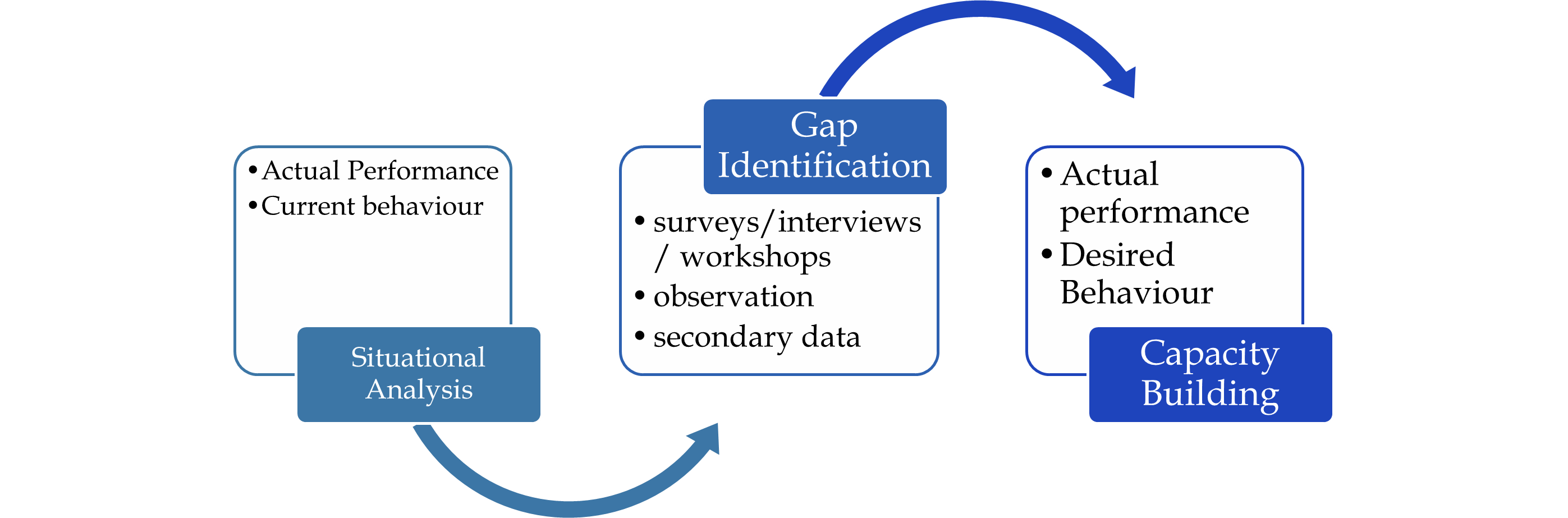

- • The project aims to more efficient and impactful insurance markets by improving the quality and quantity of insurance through a structured approach to capacity building.

- • The key objective is to develop a sustainable model for building insurance capacity in selected countries.

- • The approach is to partner with insurance training institutes, who will build their capacity to offer internationally recognized inclusive insurance training benchmarked on global experiences, lessons, and best practices.

- • The main partners are the insurance industry players i.e insurance companies, and distribution channels that are willing and committed to acquiring knowledge in order to begin serving new market segments and to improve their current offer so as to increase insurance population coverage and penetration to the GDP.

-

Who is this program for?

-

Organizations

- • Insurance players who want to design and deliver insurance products to mass markets including reinsurers, insurance companies, brokers, banks, MFIs, Mobile Network Operators.

- • Provide Social Protection to Rural Communities and Low-Income Households such as Pension Funds.

- • Technology companies developing systems and platforms for financial services.

- • Development organizations, CBOs and NGOs responsible for financial inclusion, social protection, poverty reduction and rural development.

- • Policymakers and regulators responsible for the financial sector, insurance, pension, banks and MFIs.

Individuals

- • Directors, managers responsible for strategy to grow insurance organizations and pensions.

- • Business development managers, product developers and actuaries responsible for product development and marketing.

- • Individual wishing to be internationally qualified as inclusive insurance experts.

-

Uniqueness of the Program

-

When completed, this program will manifest for the trainees the following competencies:-

- • Improving the ability to innovate and find effective solutions for development and deliver of inclusive insurance to mass markets.

- • Gaining internationally recognized experiences, insights, knowledge and skills for practical application in inclusive insurance.

- • Achieving efficiency and improved results in inclusive insurance.

- • Acquire globally recognized certification as qualified inclusive insurance experts.

-

Who we are

-

UNITED NATION DEVELOPMENT PROGRAM (UNDP)

The UNDP Insurance and Risk Finance Facility (IRFF) will deliver innovative protection solutions in 50 developing countries by 2025. Currently, the facility is operational in 20 countries. We support the development of innovative insurance products and services that are aimed towards vulnerable people and communities while also investing in the long-term transformation of insurance markets. We are working closely with industry partners to deliver policy advice, guidance, tools, methodologies, and networks that boost country and community resilience towards socio-economic, health, climate and other shocks.

THE ILO’s IMPACT INSURANCE FACILITY

Housed in Social Finance Programme of the International Labour Organization (ILO), the Impact Insurance Facility enables the financial services industry, governments, and their partners to realise the potential of insurance for social and economic development. The Facility has established itself as a global hub for knowledge and capacity development, extracting lessons from pioneers, facilitating learning, and sharing successes and challenges with all interested stakeholders.

AFRICA COLLEGE OF INSURANCE AND SOCIAL PROTECTION (ACISP)

Africa College of Insurance and Social Protection (ACISP) is a Modern Urban Pan African College providing performance and competence-based capacity-building solutions in the fields of Finance, particularly Insurance, Risk Management, Social Protection and Leadership.

ACISP’s philosophy is to provide a platform for an ongoing collaborative relationship between industry specialists, scholars, scientists and academicians to guide and steer the development of the insurance, social protection and the financial sector.